Stock buybacks can impact company culture and morale, as employees may perceive buybacks as a sign that the company is prioritizing shareholder returns over other initiatives such as employee benefits or business expansion. Stock buybacks can have varying effects on shareholders, depending on factors such as the investor’s time horizon and the company’s financial performance. The SEC closely monitors stock buybacks to ensure that companies do not engage in market manipulation or other illegal activities. In a Dutch auction, a company sets a price range within which shareholders can submit offers to sell their shares. The company then repurchases the shares at the lowest price, enabling them to buy the desired number of shares.

Introducing Price Alerts

Frequently, officers and directors are precluded from participating in tender offers. If the number of shares tendered exceeds the number sought, then the company purchases less than all shares tendered at the purchase price on a pro rata basis to all who tendered at the purchase price. If the number of shares tendered is below the number sought, the company may choose to extend the offer’s expiration date. The tax treatment of stock buybacks international tools and resources has also been a point of contention, as capital gains from buybacks are generally taxed at a lower rate than dividend income. Analysts and investors may react positively to stock buybacks if they view them as an indication of the company’s financial strength and growth prospects. Companies must adhere to specific corporate governance requirements related to stock buybacks, including board approval and shareholder communication.

Advantages and Disadvantages of Buybacks

Companies with cash on hand can use buybacks for employees and management compensation purposes, using the shares for employee stock options, The buyback helps avoid the dilution of existing shareholders. Once shareholders get used to the payouts, it’s difficult to discontinue or reduce them—even when that’s best for the company. I also considered the market conditions during each buyback period and a continued commitment to returning value to shareholders. Through this process, I aim to identify companies with a history of buybacks, those demonstrating strategic financial decisions and a dedication to enhancing shareholder value. Many companies also pay employees using stock-based compensation to conserve cash, so the net dilutive impact of those securities can be partially (or entirely) counteracted by buybacks. Yet, share buybacks can still affect a company’s valuation, either positively or negatively, contingent on how the market as a whole perceives the decision.

Would you prefer to work with a financial professional remotely or in-person?

A company reduces its equity by repurchasing shares, which can result in a higher ROE. A buyback implies that the company has nothing better to do with its money and that no investment—whether it’s replacing outdated equipment or making strategic acquisitions—can deliver a higher return than retiring shares. Elevated debt levels can impact a stock’s beta, indicating heightened volatility, as it now faces increased market risk due to its greater debt load.

Pros and Cons of Stock Buybacks

They may also buy back shares to prevent a major shareholder from taking a controlling stake in the company. If a company’s shares are overvalued, shareholders like you would be better served by the company hanging on to the cash for a rainy day. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

Buybacks vs. Dividends

Stock buybacks can influence stock price, leading to an increase in demand for the remaining shares, potentially driving up the price. The Securities and Exchange Commission (SEC) regulates stock buybacks to protect investors and maintain fair and orderly markets. In an accelerated share repurchase (ASR), a company enters into an agreement with an investment bank to repurchase a predetermined number of shares in a shorter time frame. Stock buybacks can be an alternative to paying dividends, allowing companies to return value to shareholders without directly paying out cash.

Below are the components of the ROA and earnings per share (EPS) calculations and how they change as a result of the buyback. Stock buybacks are not commonly understood, and they tend to elicit mixed opinions among investors. Some see buybacks as an opportunity for share value growth, while others see it as stock price manipulation. Stock buybacks were, in fact, illegal for most of the 20th century—until 1982, when the Securities and Exchange Commission (SEC) green-lighted the practice. A share repurchase shows the corporation believes its shares are undervalued and is an efficient method of putting money back in shareholders’ pockets.

To be clear, a buyback authorization doesn’t mean the company will buy back any shares. The reduction in dilution of ownership can indirectly create shareholder value post-repurchase. The core issue here, however, is that no real value has been created (i.e., the company’s fundamentals remain unchanged post-buyback). Based on the P/E ratio as a measure of value, the company is now less expensive per dollar of earnings than it was prior to the repurchase despite the fact there was no change in earnings.

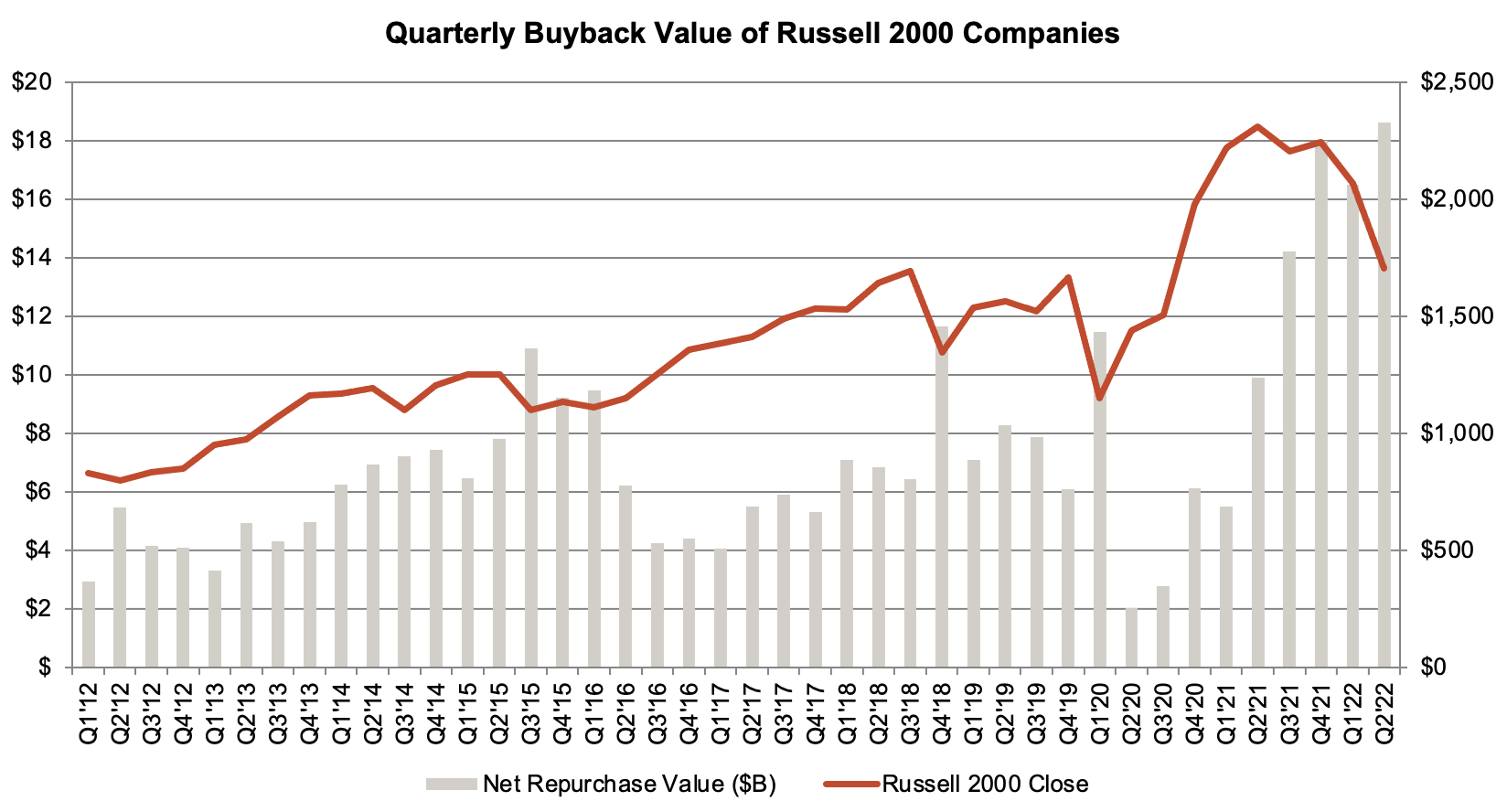

- For example, many companies are flush with cash in strong economic environments, but their valuations are also high.

- Companies with excess cash on hand may choose to initiate stock buybacks to utilize their cash reserves.

- Buybacks help increase earnings per share, and therefore can help boost a stock’s price, but as long as you hold the stock in your account, you won’t have to pay a dime in taxes.

- You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

If a company’s employees exercise options for 1 million new shares, it will dilute the stock. Over time, stock-based compensation can have a highly dilutive effect, but stock buybacks can be strategically used to keep the share count from rising too much. The company’s board will authorize the buyback, typically for a specific dollar amount with an expiration date. For example, you might read that “Company XYZ’s board of directors has approved a $500 million buyback authorization, beginning on July 1, 2024, and ending on June 30, 2025.” Reducing the number of shares outstanding affects calculations such as earnings per share, which in turn affects a widely used valuation metric, the price-to-earnings ratio. If total earnings stay constant, but the number of shares outstanding falls after a buyback, the company’s earnings per share will rise.

By using excess cash for stock buybacks, companies can maintain financial flexibility for future investment opportunities or to weather economic downturns. After all, since buybacks are so popular with investors, it actually has had an ancillary leverage effect. Buybacks, both from the market effect and the leverage effect, tend to push up stock prices. Companies now assume that they will have to keep buying shares at higher and higher prices. But the company that buys back its shares will produce a higher stock price because as its shares count falls, it forces the price higher. This assumes the market valuation stays level and all other things are equal.