In a manufacturing environment, the term raw materials refers to the items, matters or substances that are used for manufacturing a salable product. Some of these materials physically become the part of final product while others are just used to carry out the production process and don’t form the product’s physical part or component. The materials that form part of the product are called direct materials whereas the materials that just support and facilitate the process but don’t form part of the product are called indirect materials. The standard labor cost of any product is equal to the standard quantity of labor time allowed multiplied by the wage rate that should be paid for this time. Here again, it follows that the actual labor cost may differ from standard labor cost because of the wages paid for labor, the quantity of labor used, or both.

Direct and indirect materials cost

When both administrative and production activities occur in a common building, the production and period costs would be allocated in some predetermined manner. We can observe that, in many situations, the finished product of one business is used as direct materials by another business. An example of such a situation can be found in construction industry where the cement is used by house and apartment construction companies. Cement is the finished product of cement manufacturers but is used as direct material by construction companies. Tyres are the finished product of Yokohama but direct material for Mercedes Benz that uses them to complete manufacturing of its cars and other automobiles. But note that while production facility electricity costs are treated as overhead, the organization’s administrative facility electrical costs are not included as overhead costs.

Examples of indirect materials

Direct materials are requested from storage department using “materials requisition form”. This form is filled and signed by the production manager and sent to the materials manager who, after performing a formal verification, approves the requisition. The each material in requested quantity is then released and moved from the storage to production area. Indirect material costs are derived from the goods not directly traced to the finished product, like the sign adhesive in the Dinosaur Vinyl example.

Direct Labor

The accounting system will track direct materials, such as lumber, and direct labor, such as the wages paid to the carpenters constructing the home. Along with these direct materials and labor, the project will incur manufacturing which department is often responsible for the price paid for direct materials overhead costs, such as indirect materials, indirect labor, and other miscellaneous overhead costs. In order to set an appropriate sales price for a product, companies need to know how much it costs to produce an item.

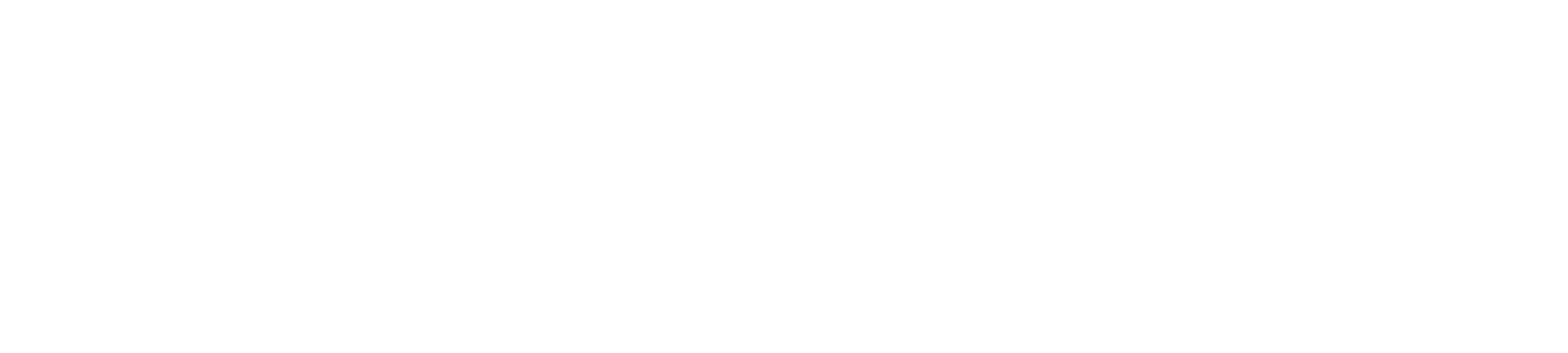

- When actual costs are less than the standard cost, a cost variance is favorable.

- The selection from the either approach is largely impacted by the entity’s costing policies.

- Often in the production process, there is a correlation between an increase in the amount of direct labor used and an increase in the amount of manufacturing overhead incurred.

- Direct labor is the total cost of wages, payroll taxes, payroll benefits, and similar expenses for the individuals who work directly on manufacturing a particular product.

- Some of these materials physically become the part of final product while others are just used to carry out the production process and don’t form the product’s physical part or component.

In traditional costing systems, the most common activities used as cost drivers are direct labor in dollars, direct labor in hours, or machine hours. Often in the production process, there is a correlation between an increase in the amount of direct labor used and an increase in the amount of manufacturing overhead incurred. If the company can demonstrate such a relationship, they then often allocate overhead based on a formula that reflects this relationship, such as the upcoming equation. While many types of production processes could be demonstrated, let’s consider an example in which a contractor is building a home for a client.

Labor rate variance The labor rate variance occurs when the average rate of pay is higher or lower than the standard cost to produce a product or complete a process. Properly allocating overhead to the individual jobs depends on finding a cost driver that provides a fair basis for the allocation. An example would be a bakery that produces a line of apple pies that it markets to local restaurants. To make the pies requires that the bakery incur labor costs, so it is safe to say that pie production is a cost driver.

Even if management is willing to price the product as a loss leader, they still need to know how much money will be lost on each product. To achieve this, management needs an accounting system that can accurately assign and document the costs for each product. The unfavorable labor rate variance is not necessarily caused by paying employees more wages than they are entitled to receive. Favorable rate variances, on the other hand, could be caused by using less-skilled, cheaper labor in the production process.

Once prepared, the bill of materials authorizes the production manager to request materials from storage department. Understanding the basic difference between direct and indirect materials is important in all businesses so that the total product cost and the business profitability can be accurately gauged. Let’s define and explain the two types of materials used in manufacturing processes with the help of some real life examples. All manufacturing entities essentially use some kind of raw materials to manufacture their output.

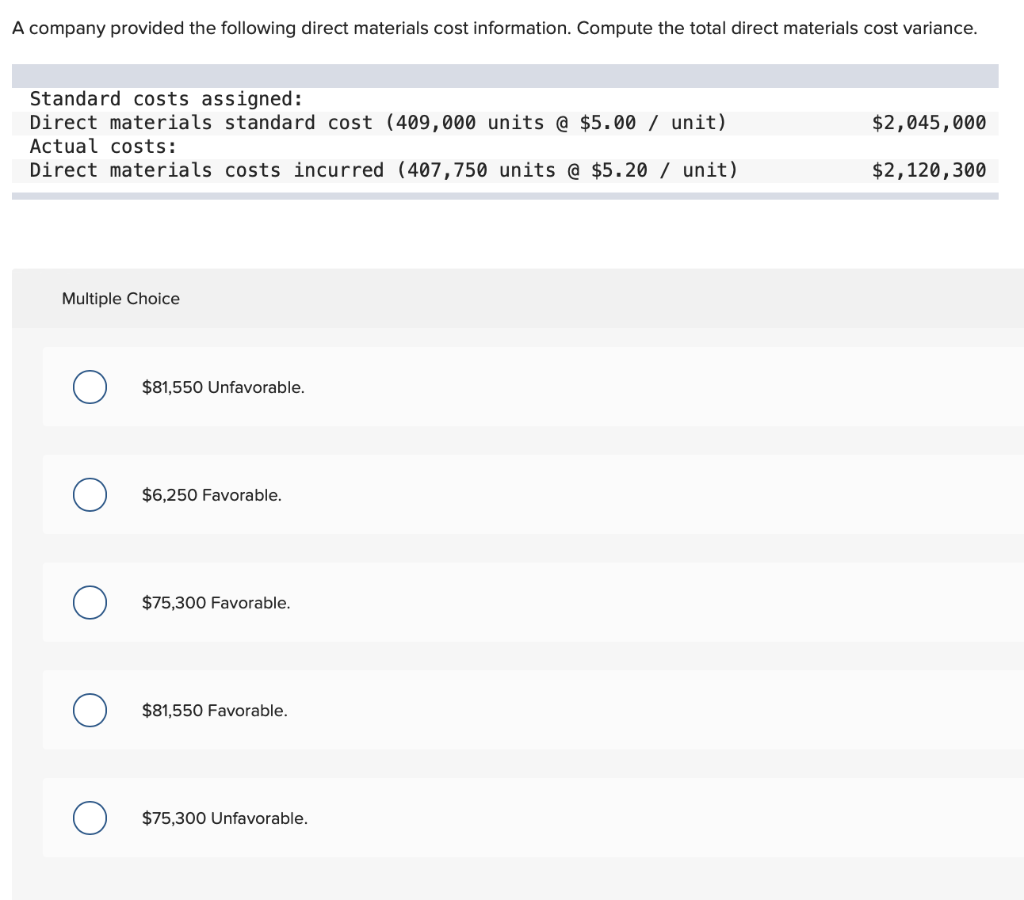

Managers use the information in the manufacturing overhead account to estimate the overhead for the next fiscal period. This estimated overhead needs to be as close to the actual value as possible, so that the allocation of costs to individual products can be accurate and the sales price can be properly determined. Determine whether a variance is favorable or unfavorable by reliance on reason or logic. If more materials were used than the standard quantity, or if a price greater than the standard price was paid, the variance is unfavorable. Each of the T-accounts traces the movement of the raw materials from inventory to work in process.

If the actual price had exceeded the standard price, the variance would be unfavorable because the costs incurred would have exceeded the standard price. We do not show variances with a negative or positive but at the absolute value with favorable or unfavorable specified. The quantity of direct materials needed to complete a unit of product is determined by the “bill of materials”. It is a well organized document which is prepared by combined effort of engineering and production department. The document contains information regarding all the items, materials and components along with their right quantities needed to manufacture a complete and shippable product.