In some cases, companies buy back stock directly from shareholders in a process known as a tender offer. As part of the Inflation Reduction Act of 2022, certain stock buybacks for domestic public companies will incur a 1% excise tax, making them more expensive for corporations. Reducing the number of shares outstanding on the market increases the proportion of shares owned by investors. But if a company is repurchasing shares of stock while it ignores other parts of the business or holds back on investing in its future growth, it’s a decision that will likely cost shareholders value in the future.

- However, during stock buybacks, shareholders can sell their stocks back to the company for cash, usually at a premium price.

- However, a company may repurchase its shares to reduce the cost of capital, consolidate ownership, preserve stock prices, and boost its key financial ratios.

- If you’re a new investor, you might not realize this yet, but few ways to lower a stock’s price are as reliable as cutting a longstanding dividend.

- For example, companies cannot repurchase more than 25% of the average trading volume of a stock, in order to prevent the supply and-demand dynamics from getting completely out of control.

- She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest.

Increase earnings per share

Alternatively, a company may create a share repurchase program and purchase shares on the open market at certain times or at regular intervals. The company had $1 million in earnings and one million outstanding shares before the buyback, equating to EPS of $1. Since 1997, more has been paid out each year through stock options than dividends from companies in the S&P 500. Over time, dividends have become a smaller part of the picture for investors than before. In the 1980s, the dividend yield for the S&P 500 was typically between 3.5% and 5.5%.

Learn why companies sometimes buy back their own stocks from shareholders.

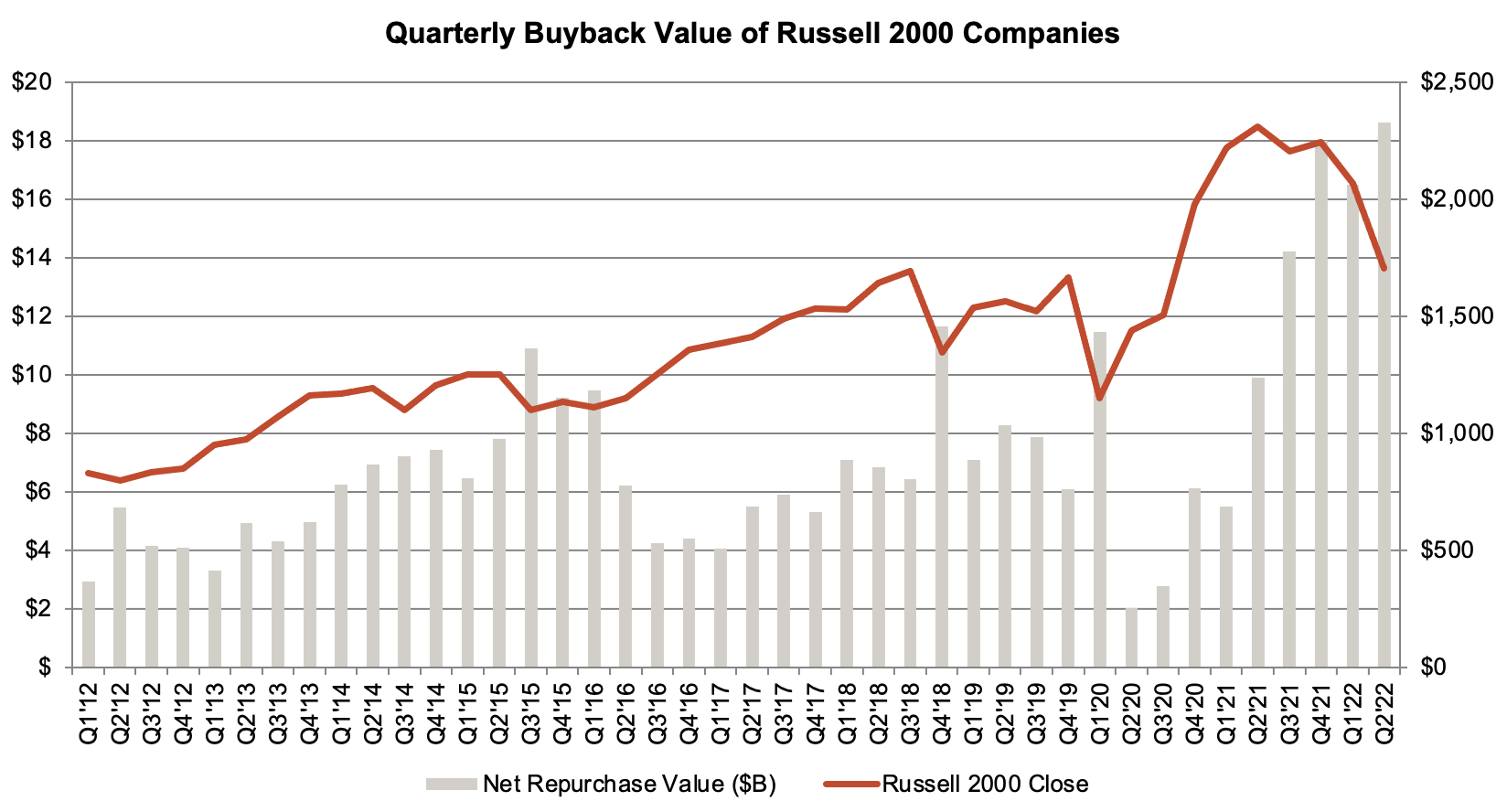

Other times, however, a shift in the market as the company is repurchasing its shares, can compromise the share value. By far, the most common way companies buy back their shares is on the open market. In other words, the company will use a broker to purchase a specified amount of shares, much in the same way you or I would do if we wanted to buy stock in a company (but probably on a much larger scale). From an investor’s perspective, stock buybacks can be a preferable method of returning capital because of their tax implications or lack thereof. Companies are able to buy back shares at any time, but share repurchases are typically highest during periods of strong economic activity when companies have the cash available. In recent years, technology companies have been some of the largest buyers of their own shares.

Why do Companies do Stock Buybacks?

Meanwhile, proponents contend that returning excess cash to shareholders is a legitimate and efficient use of capital and that restricting this practice could lead to unintended consequences. Firstly, some part of profits can be distributed to shareholders in the form of dividends or stock repurchases. The remainder of profits are retained earnings, kept inside the company period cost vs product cost period cost examples and formula video and lesson transcript and used for investing in the future of the company, if profitable ventures for reinvestment of retained earnings can be identified. However, sometimes companies may find that some or all of their retained earnings cannot be reinvested to produce acceptable returns. Stock buybacks, also known as share repurchases, are when a company buys back its own outstanding shares.

At this rate, investors should expect news of another buyback later this year. This pattern underscores management’s confidence in Home Depot’s financial stability and growth prospects and reflects a prudent use of capital to enhance shareholder returns. Considering the company’s robust cash flow, strong balance sheet and track record of disciplined capital allocation, Home Depot is well-positioned to continue its history of buybacks. Companies buy back stock to reduce the number of outstanding shares in the market, which can increase the stock’s value and improve financial metrics like earnings per share.

Economic impact

Share purchases are one method for companies to compensate shareholders, with the other option consisting of dividend issuances. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Stock buybacks have faced criticism and controversy due to concerns over short-term focus, inequality, tax implications, and executive compensation.

Stock buybacks can signal to the market that a company’s management believes its stock is undervalued and has confidence in the business’s future performance. One major purpose of buybacks is sterilization, which is the cancellation of shares that are otherwise issued to employees when their stock options or restricted stock rewards and benefits are issued. In other words, the total number of shares does not increase, as the buybacks sterilize the normal growth in share growth. As you can see, the company’s cash hoard was reduced from $20 million to $5 million. Because cash is an asset, this will lower the total assets of the company from $50 million to $35 million. A similar effect can be seen for EPS, which increases from 20 cents ($2 million ÷ 10 million shares) to 22 cents ($2 million ÷ 9 million shares).

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. With two decades of business and finance journalism experience, Ben has covered breaking market news, written on equity markets for Investopedia, and edited personal finance content for Bankrate and LendingTree.

Moreover, we will assume the company’s share price was $20.00 on the date of the repurchase, so the P/E ratio is 10x. Particularly among high-growth companies in the tech sector, most thereby opt for buybacks in lieu of dividends as buybacks send a more optimistic signal to the market regarding future growth prospects. Nevertheless, the implied share price projected by the price-to-earnings ratio (P/E) can increase post-buyback. A Stock Buyback occurs when a company decides to repurchase its own previously issued shares either directly in the open markets or via a tender offer. Stock buybacks have been criticized for exacerbating wealth concentration and inequality, as the benefits of buybacks tend to accrue to wealthy shareholders and corporate executives disproportionately.

While buybacks remain below their all-time high, U.S. companies spent $773 billion buying back their own shares in 2023 and are expected to buy back $885 billion in stock throughout 2024. When a company announces that its board of directors has authorized a new share buyback program, the company’s share price may immediately increase in value. Companies generally do not disclose when they carry out the share buybacks authorized by the board, but traders can profit from share buyback by purchasing stock when the buyback announcement is disclosed. Critics argue that stock buybacks can encourage a short-term focus, as companies may prioritize share repurchases over long-term investments in research, development, or employee benefits.

Moreover, that effect produces more value for shareholders, as they pay no taxes on this unrealized gain (until they sell shares). My calculations show that a person who owns stock in a company that raises its dividend, but does not buy back shares, will pay more income tax. Moreover, all things being equal, dividends per share will not rise and neither will the stock price. By giving a dollar amount, the company is able to gauge market conditions and decide whether the stock price on any particular day is in the target range of what they will pay. Once the company buys the shares, it generally cancels them, thereby reducing the total number of shares outstanding. Then, at the end of the quarter, it will announce how many shares were bought and the average price paid.