Bureau of Labor Statistics (BLS), and is most often found in the construction, manufacturing, and trade, transportation and utilities industries. In these and other industries where employees may frequently work overtime, a weekly pay cycle that aligns with the workweek makes tracking this information relatively straightforward. Employees who are paid weekly may also have high levels of engagement and work satisfaction since weekly pay offers steady cash flow. The average payment period is calculated by dividing the average accounts payable by the product of total credit purchases and the total days in a year. Generally, a company acquires inventory, utilities, and other necessary services on credit.

AccountingTools

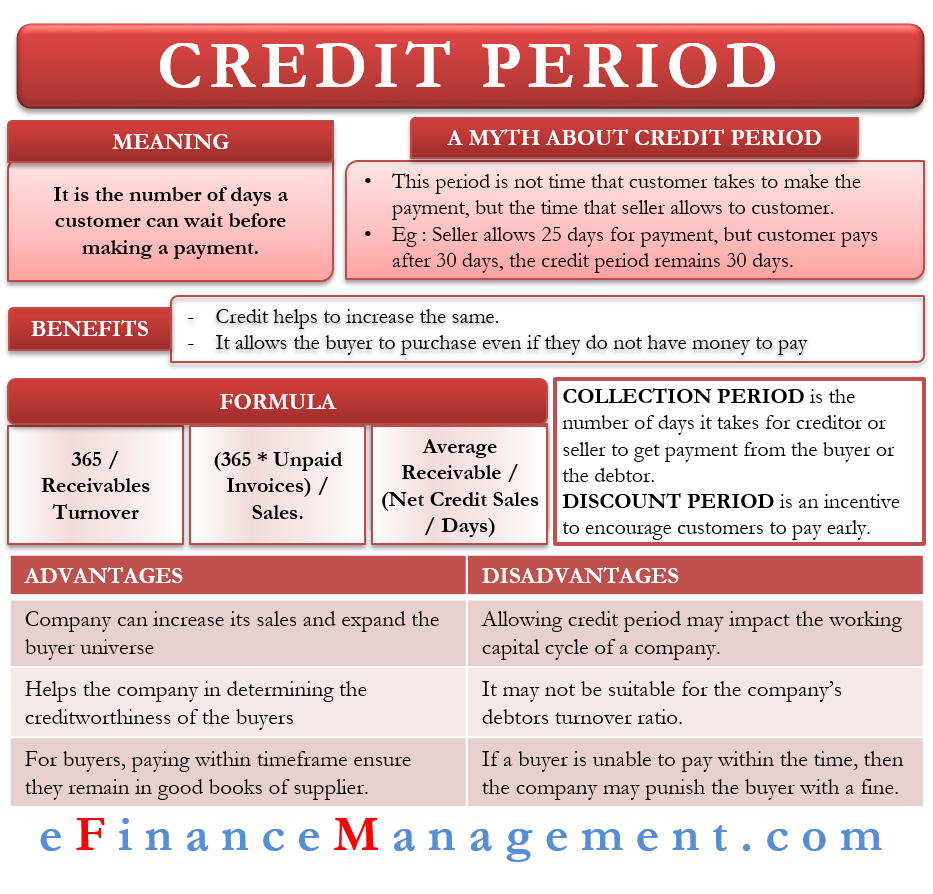

With the increased use of online payments and ACH bank transfers, payment periods do not need to be as long as the standard 30 days. Even slightly shorter payment periods, like 15 or 21 days, can make a big difference in cash flow. When terms are specified, clients and businesses alike know when to expect payment, products and discounts. Payment terms can be negotiated with clients, increasing communication and understanding in the professional relationship.

What Is the Difference Between DPO and DSO?

- This amount is then divided into the accounts payable the company has amassed in a single year, a total which can be found on a balance sheet.

- This pay frequency is common among hourly workers and smaller businesses.

- The business managers need to balance these factors for effective management of the average payment period.

- Offering clients as many payment options as possible increases convenience, which makes them more likely to pay sooner.

- These strategies can help reduce HELOC payments by allowing you to adjust your loan terms before the repayment phase begins.

- This mismatch will result in the company being prone to cash crunch frequently.

To manufacture a salable product, a company needs raw material, utilities, and other resources. In terms of accounting practices, the accounts payable represents how much money the company owes to its supplier(s) for purchases made on credit. Unlike the draw period, where you might have made interest-only payments, the full repayment period requires higher monthly payments as you pay down both the loan balance and interest. An effective set of payment terms should benefit both parties by maximizing how quickly your clients pay and minimizing inconvenience for your customer. To maintain a healthy business, remember that your payment terms should match your business plans and align with your business’s typical sales lifecycle.

How does a pay period work?

In short, payment period is a sensor for how efficiently a company utilizes credit options available to cover short-term needs. As long as it is in line with the average payment period for similar companies, this measurement should not be expected to change much over time. Any changes to this number should be evaluated further to see what effects it has on cash flows. The average payment period formula is calculated by dividing the period’s average accounts payable by the derivation of the credit purchases and days in the period.

How to Determine Pay Periods For Your Business?

A monthly pay period is a system where employees receive their wages once a month, typically on the same date each month. It’s a common pay period structure for salaried employees and can also be used for hourly employees who work a consistent number of hours each month. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.

QuickBooks

The average vertical analysis of income statement is a crucial solvency ratio for any company as it tracks the ability to settle amounts owed to suppliers. For investors and stakeholders, understanding the average payment period is essential for making informed decisions and identifying potential investment opportunities. Also, calculating the average payment period provides valuable information about the company, including its cash flow position, creditworthiness, and more.

The formula can be modified to exclude cash payments to suppliers, since the numerator should include only purchases on credit from suppliers. However, the amount of up-front cash payments to suppliers is normally so small that this modification is not necessary. Understanding the DPO reflects current AP workflows, showing where improvements should be made. For example, late payments can lead to costly fees and penalties and damage supplier relationships.

Accounting software like QuickBooks can set up automatic and recurring payments and email invoices to customers with direct payment links. QuickBooks also offers pay-enabled smart invoices that clients can pay using credit cards, debit cards and ACH bank transfers. When analyzing average collection period, be mindful of the seasonality of the accounts receivable balances. For example, analyzing a peak month to a slow month by result in a very inconsistent average accounts receivable balance that may skew the calculated amount. The average collection period is an accounting metric used to represent the average number of days between a credit sale date and the date when the purchaser remits payment.